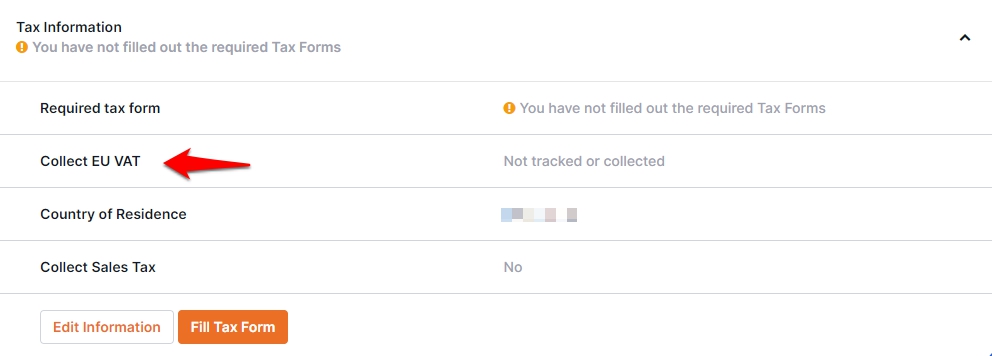

You can opt in to EU VAT and change EU VAT settings by going to My Account > Account Details. Scroll down to Tax Information and click "Edit Information."

There are two sets of options. The first option is who will pay the VAT. The tax can be added to the price of the product and the customer will have to pay the tax, or the Seller can pay the tax from sales profits.

You can also decide how the tax is charged. Prior to 2015, VAT could be charged based on the Seller's country. As of 2015, the new laws state that the buyer's country should be used to determine the VAT tax rate. You can choose the rate in the second section.

The VAT payments to the government are handled by the Seller. It is the Seller responsibility to ensure that the taxes are paid at the correct rate.

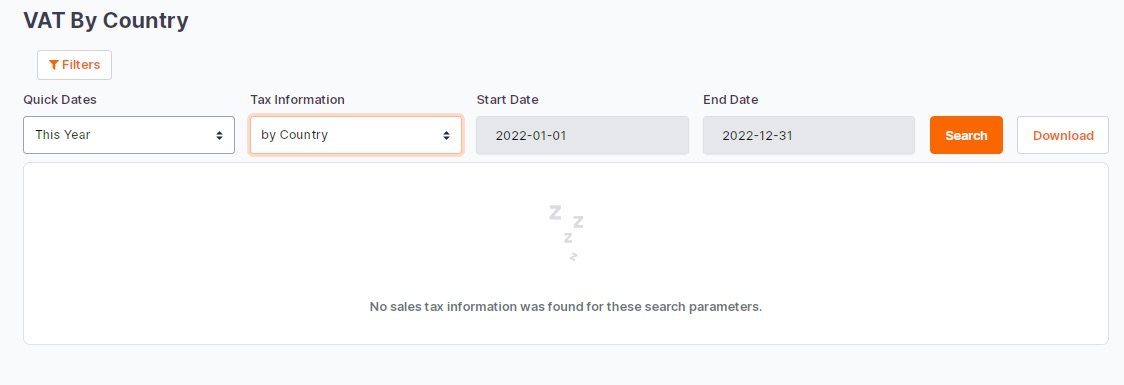

You can find a breakdown of exactly how much the taxes are by going to the Sellers > Reports > VAT Reports and selecting either Tax Information by Country or By Transaction in the dropdown.

As required by European law, JVZoo detects the location of the buyer. This is done by IP address and a confirmation by the buyer.